workers comp settlement taxes

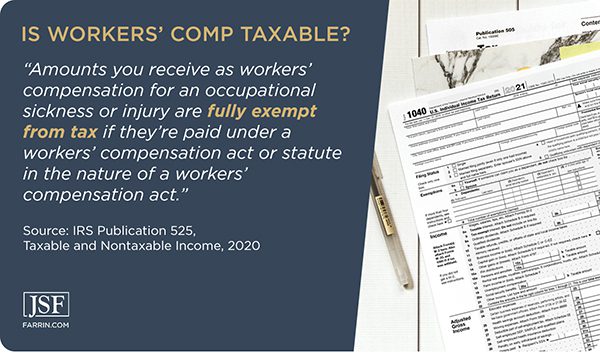

For instance if your SSDI benefits were. Compensation from workers comp earned from occupational injuries or illnesses is fully tax-exempt provided the insurance carrier adheres to state workers compensation.

Workers Comp Settlement Program Falls Short By 242 Million L I Announces Fuels Debate Over Reform Bill Washington State Wire

As you prepare to go.

. The short answer is no. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income. That is if you put 40000 in.

It doesnt matter whether youre receiving monthly payments or a lump sum settlement. Since workers compensation is a payment you oftentimes. Do you pay taxes on a workers comp settlement.

Workers compensation is a tax-funded benefit and the main reason why it is exempt from taxes in the overwhelming majority of cases. If a worker settles a workers comp case and also receives SSDISSI benefits and the settlement is an amount above 80 of their pre-injury income then their workers comp may get taxed. We prepare for every case as if we are going to trial and have no hesitation which motivates opponents to settle out of court and with a sizable amount.

Up to 25 cash back Taxes and Workers Comp Benefits. Under the Income Tax Assessment Act 1997 the payment of a lump sum amount in relation to a. However theres an exception.

No cash benefits from the VA are not taxed. Your workers compensation benefits would be taxed equivalent to the amount that Social Security deducts from your SSDI payments. If you would like to speak with our accountant to discuss your work compensation audit call 718-375-8888.

When will workers comp offer a settlement. Thus workers comp settlements are not taxable both at the state and federal level. Workers compensation also extends to an employees dependents should the workplace injury result in the employees death.

Generally you dont have to pay state or federal taxes on your workers compensation settlement or award. If you receive social security. Generally the answer is no Workers compensation payments are typically not considered taxable income.

Have Your Records Ready for Your Work Compensation Audit. No type of workers comp benefit is taxed. When a worker gets injured on the job site among the first and most popular questions asked is.

Otherwise paying taxes from this benefit would be. This tax-free status applies to monthly benefits checks lump sum payments. If you put your lump sum settlement into an investment account and earn interest on that money then you can be taxed on the capital gain.

The usual timeline for settling.

Are Workers Comp Benefits Taxable In California

Workers Compensation Settlement Phalenlawfirm Com Ks Or Molaw Office Of Will Phalen

Pay Taxes On My Benefit Payments Or Personal Injury Settlement

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Is Workers Comp Taxable Gordon Gordon Law Firm

What Wages Are Subject To Workers Comp Hourly Inc

How To Get A Workers Comp Settlement The Ferrara Law Firm

Are My Workers Comp Benefits Taxable In Massachusetts

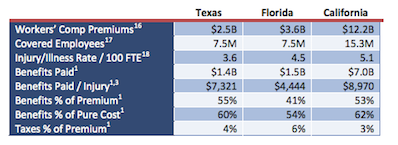

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Is Workers Compensation Taxable Klezmer Maudlin Pc

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable In Nj Craig Altman

Is Workers Compensation Taxable In Texas Thompson Law Call 24 7

Workers Comp Settlement Amount Jodie Anne Phillips Polich P C

Is Workers Comp Taxable Gordon Gordon Law Firm

Is Workers Comp Taxable Workers Comp Taxes

Are Workers Compensation Settlement Taxable The Law Office Of D Hardison Wood

Is Workers Compensation Taxable Workinjurysource Com

Workers Comp Settlements In Pennsylvania Calhoon And Kaminsky P C